non taxable income malaysia

Region Country Name Tax Revenue of GDP GDP Billions PPP Tax Revenue Billions of GDP nominal. Income tax rates by type of income.

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

. 19 for the first EUR 6000 of taxable income. Taxable income band MYR. You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year regardless of nationality.

Tool requires no monthly subscription. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Interest and taxable dividend income Report all Canadian and foreign-source interest paid or credited to you in 2021 inlcuding interest income from bank accounts term deposits guaranteed investment.

Engine as all of the big players - But without the insane monthly fees and word limits. As of 2021 15 tax rate is applied for the disposal of securities and sale of property. Health care systems classification by country Countries with universal government-funded health system.

The percentage of modified taxable income that is compared against the regular tax liability increases to 125 135 for certain banks and securities. It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age. This article provides a brief overview of the health care systems of the world sorted by continent.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. 21 Government grant or subsidy.

Income Taxes in Malaysia For Non-Residents. US taxation of income earned by non-US persons depends on whether the income has a nexus with the United States and the level and extent of the non-US persons presence in the United States. Find Out Which Taxable Income.

The SEC staff has indicated that in certain limited circumstances it may be appropriate to include income from equity. Savings taxable income is taxed at the following rates. Taxable income band MYR.

News from San Diegos North County covering Oceanside Escondido Encinitas Vista San Marcos Solana Beach Del Mar and Fallbrook. There is no capital gains tax for equities in Malaysia. However in certain cantons special methods of assessment may apply for dividend and other income originating outside Switzerland.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

Non-resident individuals are taxed only on their Sri Lanka-source income. Taxable income band MYR. Utilities 88 to CAD 2034 retail trade 85 to.

Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. Malaysia business and financial market news. 21 for the following EUR 6000 to EUR 50000 of taxable income.

Govt Expenditure Public Debt Europe France 462. Residents and non-residents are taxed on income derived from the country. Dividends interest and royalties from Swiss or foreign sources are included in taxable income.

Directors fees income received as a non-Malaysian citizen director of a Labuan entity are exempted from income tax until YA 2025. In this case the taxpayer may choose to apply the tax regime for non-taxable excess amounts instead of this tax exemption. 12 VAT or 1 percentage tax as applicable.

Find out which income can be exempted from income tax in Malaysia for 2022. It was the 14th consecutive month of growth in average weekly earnings with 12 of the 20 sectors reporting gains in average weekly earnings in July. The same rule applies for income from real estate property situated abroad.

IMoneymy Learning Centre All Categories. Business income subjected to graduated tax rates shall also be subject to business tax ie. If you are reporting only Canadian-source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from a business without a permanent establishment in Canada including a non-resident actor electing to file under section 2161 or if you are filing an elective.

Content Writer 247 Our private AI. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or the graduated tax rates. Capital gains in Lithuania are taxed as a general taxable income therefore personal income tax or corporate income tax apply.

Certain types of income derived in Malaysia by non-residents are subject to final withholding tax at the following rates. Advance Pricing Arrangement. S-X 5-03 generally requires equity method earnings to be presented below the income tax line unless a different presentation is justified by the circumstances.

Personal income tax PIT rates. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. The presentation in Example FSP 10-1 is consistent with the presentation requirements of S-X 5-03.

Tax rate Cumulative tax on the taxable income equal to the higher of the range LKR Over. Use the worksheet on the back of your return to calculate your interest income taxable dividend income and capital gains or losses. An individual retirement account is a type of individual retirement arrangement as.

Average weekly earnings of non-farm payroll employees in Canada rose by 29 year-on-year to CAD 116323 in July of 2022 continuing their growth since June 2021. Malaysia used to have a capital gains tax on real estate but the. Over 500000 Words Free.

An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. SOURCE PRINCIPLE OF TAXATION -- Principle for the taxation of international income flows according to which a country consider as taxable income those income arising within its jurisdiction regardless of the residence of the taxpayer ie. In this system also known as single-payer healthcare government-funded healthcare is available to all citizens regardless of their income or employment status.

The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. IRBM Public Key. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. Resident individuals are subject to income tax on their worldwide income. Foreigners who qualify as tax-residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are.

8 Countries With Zero Foreign Income Tax

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysian Tax Issues For Expats Activpayroll

Taxation In New Zealand Wikipedia

Ppt Tax Education Course Lecture 3 Powerpoint Presentation Free Download Id 4021963

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

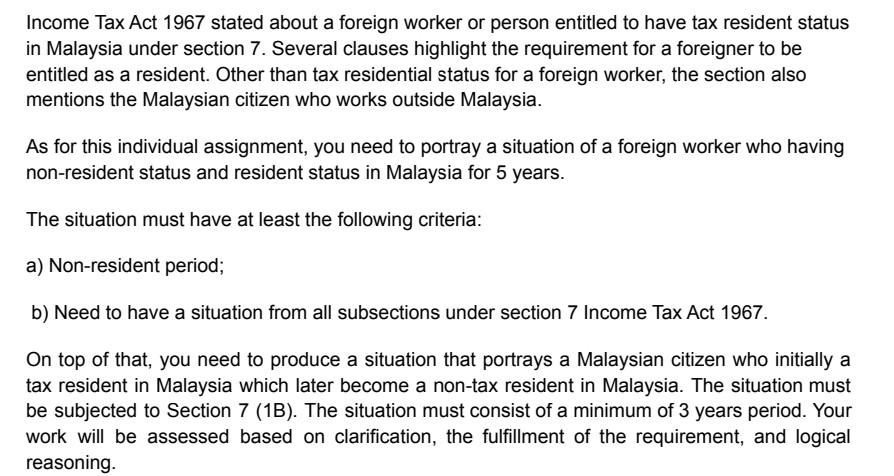

Solved Income Tax Act 1967 Stated About A Foreign Worker Or Chegg Com

Withholding Tax On Foreign Service Providers In Malaysia

Withholding Tax On Interest Income For Non Resident Company In Malaysia

Table Ii From Tax Reporting For Non Profit Organizations Npos In Malaysia Semantic Scholar

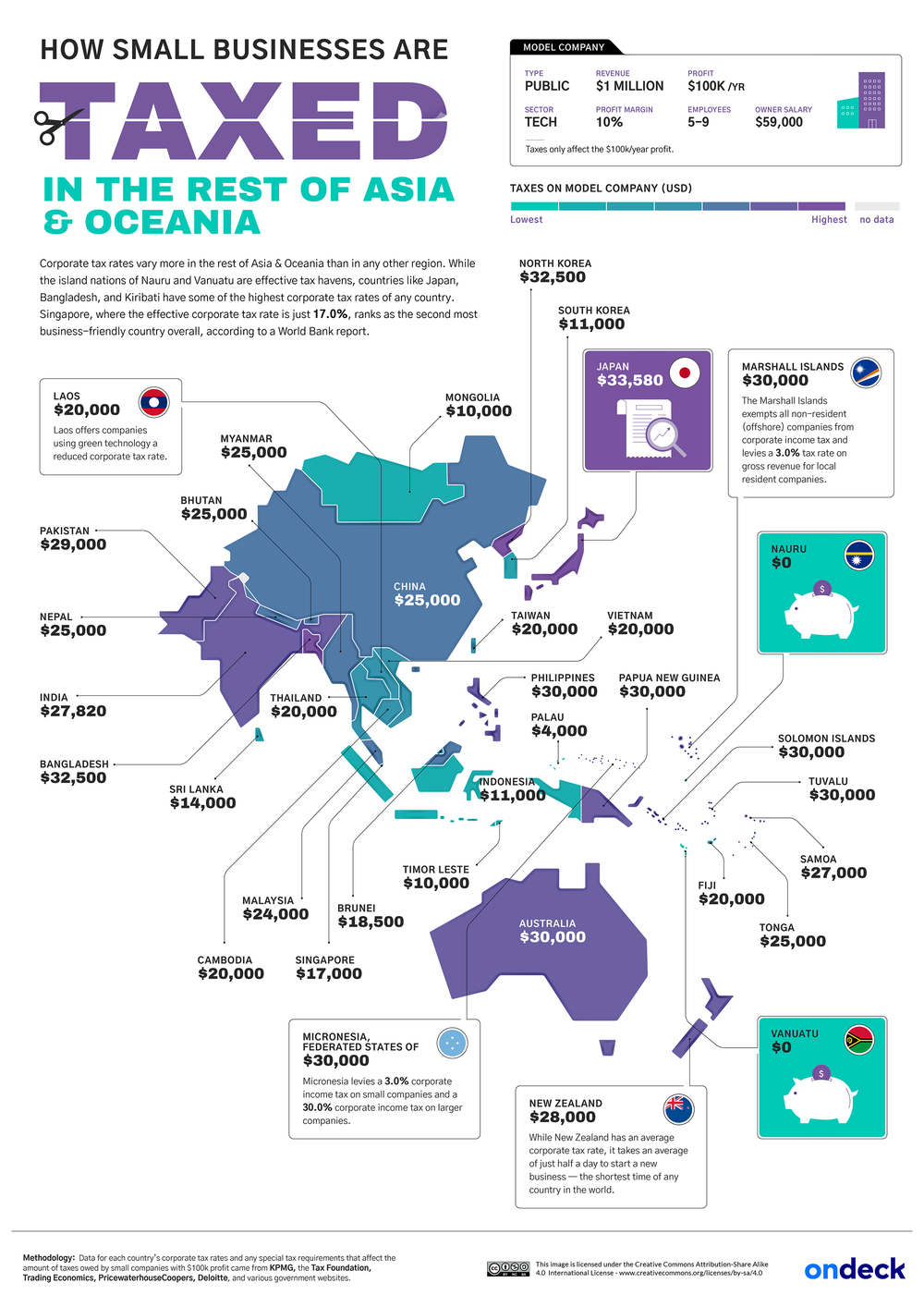

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

Income Tax Formula Excel University

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

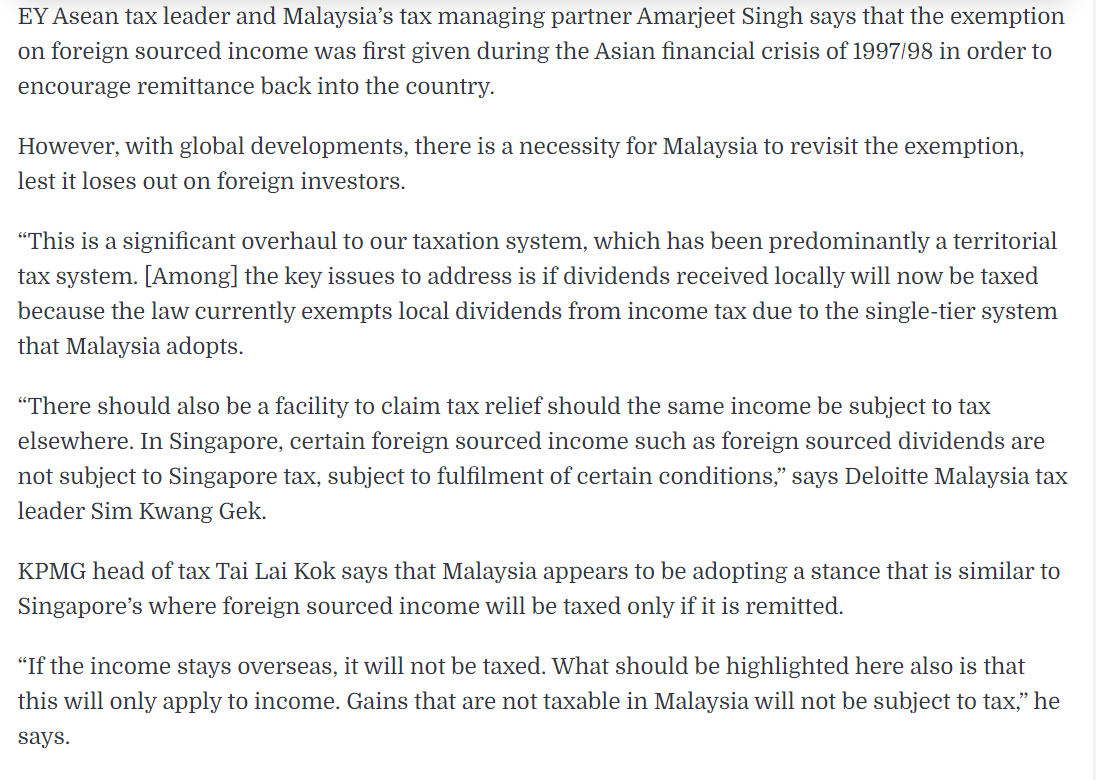

Come Jan 1 2022 Foreign Sourced Income Received In Chegg Com

What Type Of Income Can Be Exempted From Income Tax In Malaysia

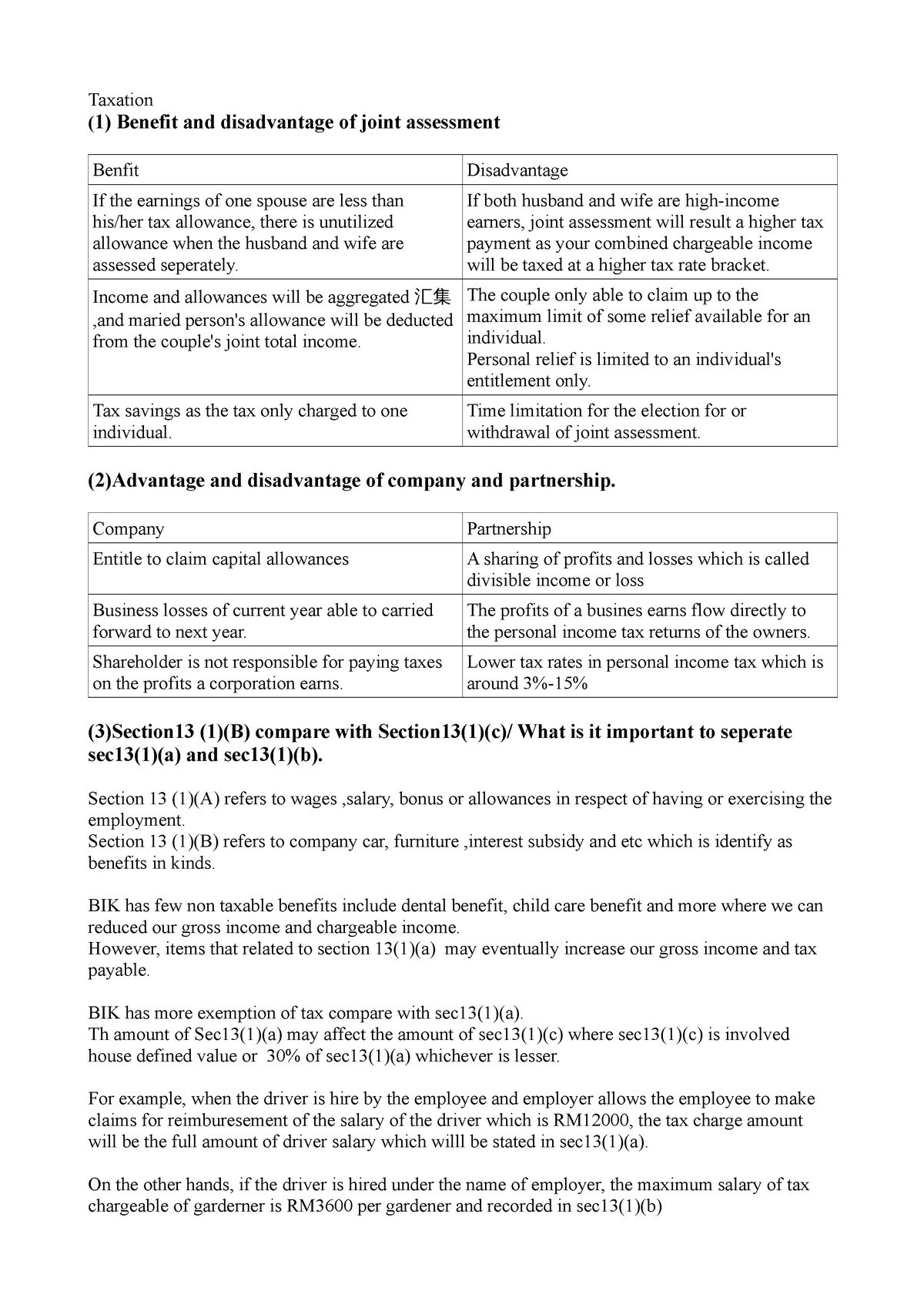

Taxation Malaysia Taxation 1 Benefit And Disadvantage Of Joint Assessment Benfit Disadvantage If Studocu

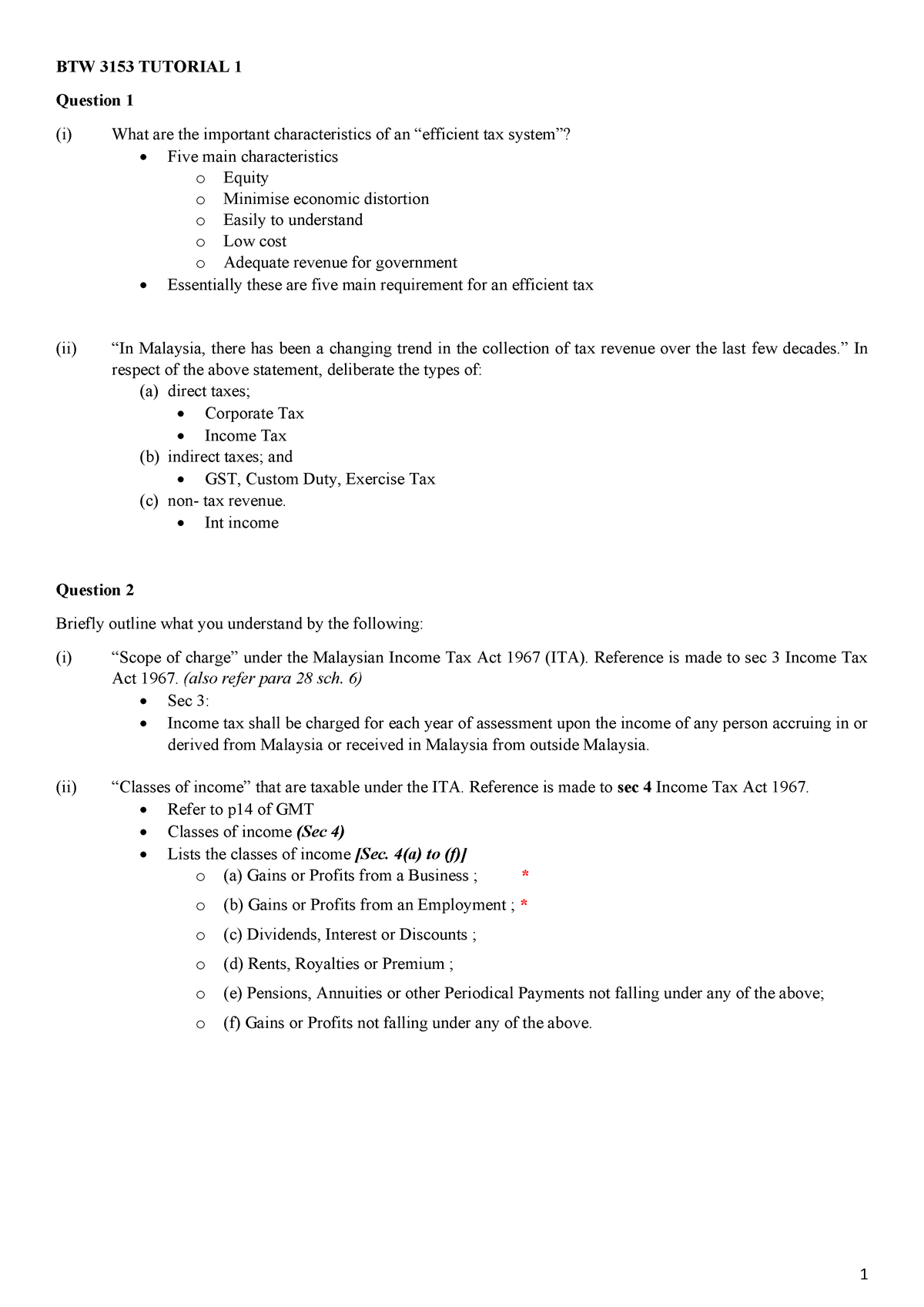

Tutorial 1 Btw 3153 Tutorial 1 Question 1 I What Are The Important Characteristics Of An Studocu

Comments

Post a Comment